If you are eligible, you must complete the electronic Commonwealth Assistance Form (eCAF) if you want to:

Whether you wish to pay up-front or defer your liability through HECS-HELP, all Commonwealth supported students must submit an electronic Commonwealth Assistance Form (eCAF) to indicate how you will pay your student contribution amount.

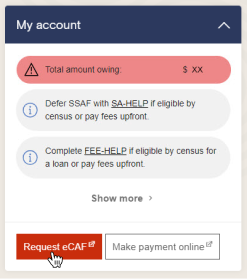

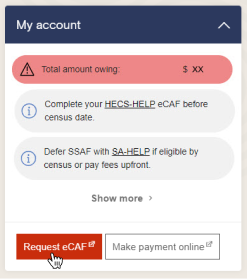

Log in to the student portal and select Request eCAF from the My Account card on the homepage.

Next, read through the information carefully, answering any applicable questions and confirming the pre-populated information.

When you are sure the information is correct, select submit to complete your application.

Once you’ve submitted your Request for electronic Commonwealth Assistance Form, you’ll receive an email from the Department of Education, Skills and Employment containing a passkey, link and steps to complete your electronic Commonwealth Assistance Form.

It can take up to 24 hours to receive a confirmation email from the Government system.

You’ll need:

Your passkey is a unique identifier emailed to you from the Australian government. You’ll receive a separate passkey for each loan type you request. For example, if you request both FEE-HELP and SA-HELP, you’ll receive a separate passkey for each, unique to that request. If you’re enrolled in concurrent study (two courses at the same time), you’ll need to submit a request for each degree. You’ll receive separate passkey’s for your electronic Commonwealth Assistance Form. If you’re unable to locate your email, you can: You must be able to provide your Tax File Number (TFN) or your certificate of application and post-office receipt when submitting the Commonwealth Assistance Form to request a HELP loan. It takes about 28 days for a TFN to be issued. How you apply for a TFN depends on your circumstances, see more information on the Australian Tax office website. You must supply your Unique Student Identifier (USI) to the University. You can supply your USI as part of the eCAF or via the USI Stand Alone Form. You must have a Unique Student Identifier (USI) before you can submit your request for Commonwealth Assistance. A USI is a reference number made up of a combination of ten numbers and letters. The USI is used to connect your Commonwealth supported loan information to your details. Providing your USI to your university is a Federal Government requirement. If you have undertaken any training since 2015, you may already have a USI. If you need to apply for one, it will only take a few minutes.

Your passkey

Your tax file number

If you don't have a TFN

Your Unique Student Identifier (USI)

What is a USI?

How do I get a USI?

Read through the information carefully, answering any applicable questions and confirming the pre-populated information.

Once you are happy everything is in order, select submit to finalise your government eCAF request.

Once you have submitted your government eCAF, you’ll receive an email confirming your personal details, course and fee payment information.

If you can't see the confirmation email, check your junk mail or spam folder. You can also add ecafsystem@education.gov.au to your safe sender list to ensure the confirmation email arrives in your inbox.

To successfully submit your electronic Commonwealth Assistance Form, you need to ensure your details are correct. The information provided to Charles Sturt University must match the details you have provided to the Australian Taxation Office and USI.

If you need to change your name, date of birth or gender, you’ll need to email us with supporting legal documentation.

You can update your email and address at any time.

If your course details are incorrect as you’re enrolled in concurrent study, check your student portal log in details. You may need to switch which course you’re viewing in the Student Portal. You can do this via the Switch Course function at the top right corner of the Student Portal home screen. Once you’re in the correct view, submit a Commonwealth assistance request form.

If you want to defer your fees, you'll need to apply for a tax file number (TFN) as soon as possible. It takes approximately 28 days for your request to be processed by the Australian Taxation Office (ATO).

You can submit your electronic Commonwealth Assistance Form (eCAF) once you’ve submitted your application. Keep your Certificate of Application for a Tax File Number (TFN) which will be issued after your appointment with Australia Post as proof that you have applied for a TFN. You’ll need to upload this document to complete your eCAF.

If you don’t provide a copy of your Certificate of Application or a valid tax file number, you won’t be able to defer your subject fees. You’ll need to make full upfront payment before each census date.

You must provide your tax file number to us within 21 days of receiving it.

HELP loans are available to eligible students to assist you in paying your:

To be eligible to defer your fees you must:

Submit your electronic Commonwealth assistance request form

If you’re a New Zealand citizen (who does not hold a SCV and/or does not meet the long-term residency criteria) or the holder of a permanent (non-humanitarian) visa, then you’re eligible for a Commonwealth Supported Offer and are required to complete an electronic Commonwealth Assistance Form. However, you cannot defer your fees via HECS-HELP. Your student contribution must be paid upfront to Charles Sturt University.

New Zealand Special Category Visa (SCV) holders who live and study in Australia, may be eligible for HELP loans.

To be eligible you must meet the following criteria:

You can obtain copies of your international movement records, confirming your residency, from the Department of Home Affairs by lodging a Request for International Movement Records with them. This can take up to 28 working days for the documents to be emailed to you.

You're required by Australian Government legislation to present evidence to the university that you have been living in Australia for the qualifying period on or before census date.

Once you have this record, you'll need to email us the full document for assessment.

After your third incorrect attempt at logging into the electronic Commonwealth Assistance Form, you’ll be locked out. You can unlock your eCAF by submitting a new Commonwealth Assistance request form via your student portal or contact us. You'll receive a new passkey once your new request has been submitted.

If you’ve recently accepted admission into a Commonwealth supported place in your degree, you're required to complete an electronic Commonwealth Assistance Form(eCAF). This is your acceptance of the commonwealth government subsidy for your subject fees.

When you complete the eCAF, you can nominate if you’ll pay your student contribution fees upfront or if you’ll defer partial or full payment to your HECS-HELP loan.

To request data from a previous eCAF submission, send an email to enrolment@csu.edu.au.

Use "Previous eCAF Submission Data" in the subject line.

You'll also need to include the following information with your request:

Your myGov account will show you how much you owe and any repayments you have made.

The myHELP balance portal will show your available HELP balance (the amount you have available to borrow using HELP loans).